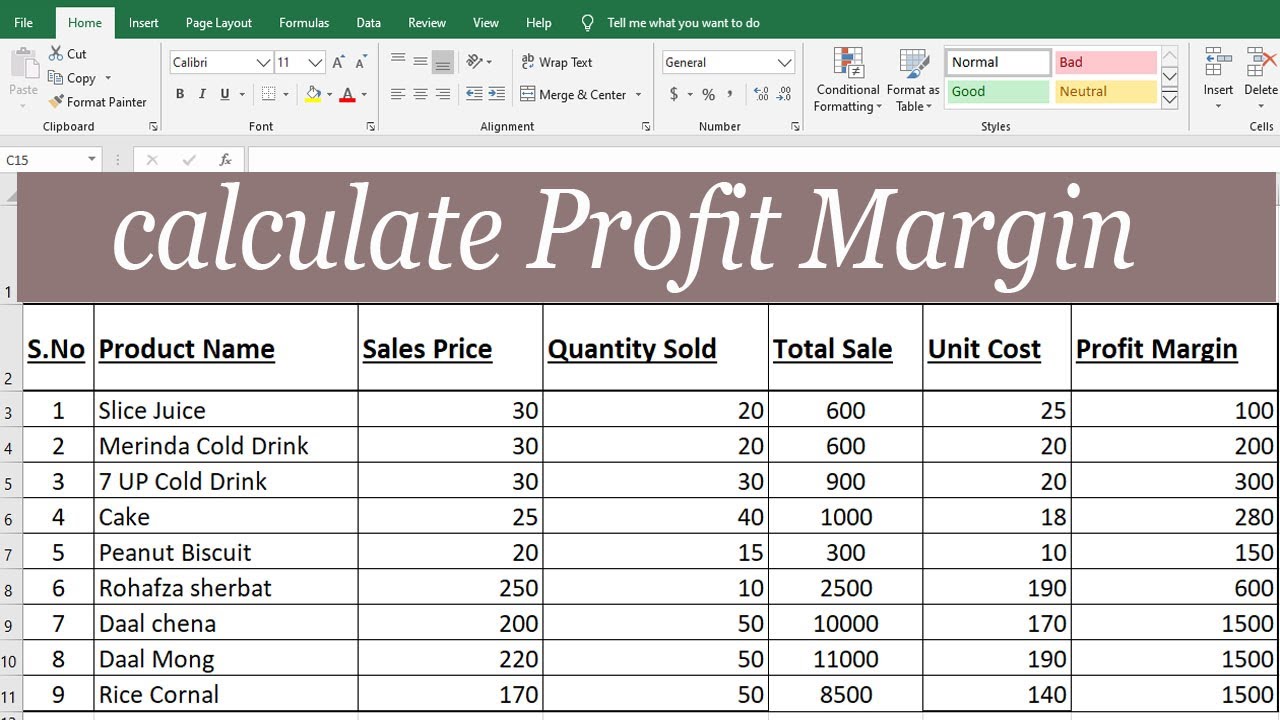

How to Calculate Profit Margin

Using the income statement above Chelsea would calculate her net profit margin as. In our example the gross profit margin is 100 divided by 100 so we get a profit margin percentage of 100 percent.

Profitability Strategy To Rocket Your Net Profit Business Development Strategy Profit Margins Business Development Strategy Net Profit Business Development

In other words for every dollar of revenue the business brings in it keeps 023 after accounting for all expenses.

. Gross Profit Margin Total Revenue Cost of Goods SoldTotal Revenue x 100. To calculate your profit margin just divide your net profits by your sales price and multiply that number by 100. To calculate gross profit we need to start with the gross sales The Gross Sales Gross Sales also called Top-Line Sales of a Company refers to the total sales amount earned over a given period excluding returns allowances rebates any other discount.

Sales Price 857 1 - 27 100. Profit margin percent can be calculated using the above method. To calculate the sales price at a given profit margin use this formula.

Gross Profit Margin Example. Profit Margin is calculated by finding your net profit as a percentage of your revenue. In this example the percentage is.

Tinas T-Shirts is based out of Carmel-by-the-Sea California. It is determined by subtracting the cost it takes to produce a good from the total revenue that is made. Here we discuss the formula to calculate Net profit margin and practical examples uses and interpretations.

12500 55000 23. Lets use an example which calculates both. Revenue 100 profit margin.

In simple terms this is done by dividing your net profit by your net sales. Press Enter to calculate the formula. Other profit ratios such as net profit margin reflect different measures of profit.

Copy the formula in the remaining cells to get the percentage change of profit margin for the rest of the data. 5 Repeat this procedure with several potential products to figure out the most profitable goods for your business. Gross Profit Margin.

Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses. Learn more from the following articles Return on Average Capital Employed Formula. The difference is gross profit.

Margin 100 revenue - costs revenue. Gross profit margin shows how efficiently a company is running. Type an then click the Margin Cell type a and then click the Sale Price Cell.

A profit margin calculator can help you determine the exact profit margin calculate costs of products and services evaluate if a project is profitable measure revenue and other values. This calculator can help you determine the selling price for your products to achieve a desired profit margin. Gross_margin 100 profit revenue when expressed as a percentage.

To calculate the Gross Profit Margin percentage divide the price received for the sale by the gross profit and convert the decimals into a percentage. Gross Profit Margin x 100. Hope you understood how to calculate the Percentage margin profit of a set of values.

Its your profit before you pay tax. For example a 15 operating profit margin is equal to 015 operating profit for every 1 of revenue. A vendor purchased a book for 100 and sold it for 125.

Gross Profit Margin Gross Profit Net Sales. For example 001 equals 1 01 equals 10 percent and 10 equals 100 percent. By entering the wholesale cost and either the markup or gross margin percentage we calculate the required selling price and gross margin.

This makes the gross profit margin only useful for tracking the direct cost of operations as a percentage of sales. Profit Margin is the percentage of the total sales price that is profit. Her business has not been in operation very long only a year and she wants to get a.

Lets understand the application of these formulae with the following simple example. Net margin can be expressed as a percentage value or as a dollar value called net profit. How to Calculate Gross Profit Margin.

Subtract the cost of the voucher from the price received from its sale. Calculate gross profit margin. How to Use Operating Profit Margin.

This article has been a guide to Net Profit Margin and its definition. The formula for gross margin percentage is as follows. Profit revenue - costs so an alternative margin formula is.

To calculate net. Convert gross profit margin to a percentage. As weve already figured out you need two parameters variable charges and total earnings.

Profit Percentage Margin Net Profit SP CPSelling Price SP X 100. Now we will show you the steps to help you learn how to simplify the formula on your own. For example if you sell 15 products for a net revenue of 400 but the cost to source and market your product coupled with business costs equals 350 then your profit margin is 400-350400.

How to calculate net profit and margin. In the example here the formula is. To calculate gross profit margin subtract the cost of goods sold COGS from revenue.

Net margin is your gross margin less your business overhead expenses. Subtract the smaller value from the larger one to get gross profit. Read moreGross sales are the first item in an income statement.

Net Profit Margin Net Profit Revenue. Compare Operating Profit vs. Following the steps above we.

With a cost of 857 and a desired profit margin of 27 sales price would be. For instance the study showed that the hotelgaming sector had an average net profit margin of -2856 while banks in the money center had. Now that you know how to calculate profit margin heres the formula for revenue.

Calculate the net profit margin net profit and profit percentage of sales from the cost and revenue. Net Cash Flow Definition. The formula for calculating net profit margin is.

With the right calculations you can create an accurate pricing strategy for your business increase income save money and grow your company. Lets say your business has sold 150000 this quarter with a cost of goods sold COGS of 80000. The profit equation is.

The formula to calculate gross profit margin as a percentage is. The difference is that the former is based solely on its operations by excluding the financing. Operating Profit Margin differs from Net Profit Margin as a measure of a companys ability to be profitable.

As you can see in the above snapshot first data percentage of profit margin is 8. When you calculate Operating Profit Margin ratio for tech-based companies like Apple Facebook Google Alphabet and Microsoft you will observe that the ratios are in higher range of 20-50 Apple The Operating margin in the case of Apple has been disappointing for the past 5 years. While they measure similar metrics gross margin measures the percentage or dollar amount of the comparison of a products cost to its sale price while gross profit measures the percentage or dollar amount of profit from the sale of the product.

The first one deals with learning gross income. How to Calculate Gross Profit Margin for a Service Business. Select the cell that will display the gross margin and divide the margin by the sale price.

Sales Price c 1 - M 100 c cost. Now we need to calculate the profit percentage markup as well as margin. Sometimes the terms gross margin and gross profit are used interchangeably which is a mistake.

The net profit margin is net profit divided by revenue or net income divided by net sales. The first component is gross profit. The GPM calculation comprises three steps.

Tax isnt included because tax rates and tax liabilities vary from business to business. M profit margin Example. For gross profit gross margin percentage and mark up percentage see the Margin Calculator.

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

How To Calculate Gross Profit Margin Profit Profitable Business Cost Of Goods Sold

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

How To Calculate Net Profit Margin In Excel Net Profit Excel Billing Software

Comments

Post a Comment